The metalworking industry faces many uncertainties amid a changing economic climate. Already confronting the probability of slowed economic growth going into 2020,1 financial expectations became even more uncertain as the coronavirus outbreak spread worldwide.

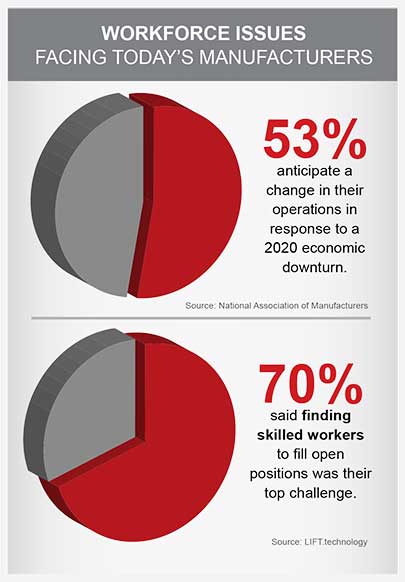

In a survey conducted by the National Association of Manufacturers in early 2020, 78% of respondents said that uncertainty around the COVID-19 outbreak was likely to have a negative financial impact on their businesses. More than 53% of manufacturing firms reported they anticipated a change in their operations in the months that followed the outbreak.2

Looking back, manufacturers and fabricators took a brunt of the jobless hit during the Great Recession. Between late 2007 and 2010, the U.S. economy suffered 9 million job cuts and the unemployment rate reached 10%.3 Fastforward to March 2020, when companies quickly pivoted to lower spending through staff reductions in response to an economy that began to contract almost instantaneously.4 Many manufacturers will be looking for ways to drive efficient production with fewer hands on deck.

The pandemic also brought to light a new vulnerability for metalworking operations: in a time when a skills gap has already created a shortage of qualified workers, what would a metalworking plant do if a significant number of its workers became ill for an extended period of time? Prior to the anticipated 2020 economic downturn, multiple reports and studies estimated that nearly 2.5 million manufacturing jobs would go unfilled through 2028 in part due to the skills gap.3 According to a 2018 Grainger report, 59% of metalworking firms reported having a difficult time finding and retaining qualified employees, and 45% struggled with competency levels in their workforce.5

LIFT, a developer of advanced lightweight materials manufacturing technologies, reported similar findings in its own 2018 online article, Help (Still) Wanted: Manufacturers Struggle to Fill Open Jobs. LIFT cited a Plant Services magazine survey of more than 270 readers who were asked about their organization’s biggest workforce challenges. At that time more than 70% said finding skilled workers to fill open positions was their top challenge.6

Clearly, employers in the metalworking industry are confronted with a variety of challenges with regard to meeting revenue goals and workforce management needs. In this white paper, we will discuss some of the reasons why industrial production operations will continue to face a growing shortage of skilled workers and other operational challenges. We will also describe how automated conveying, scrap processing and fluid recycling equipment can minimize the impact of this issue while also adding considerable value in other areas.

Industry experts and observers offer several explanations for the workforce and operational challenges facing metalworking operations. Among the most significant are:

In response to a contracting economy, some metalworking companies will lower expenses through labor cuts. GE’s aviation division, for example, cut 10% of its workforce in response to the economic fallout that resulted from the coronavirus outbreak.4 Turnover in manufacturing has also remained a challenge. According to a report from Tooling U-SME, The True Cost of Turnover: Hidden Cost Go Beyond Financial to Impact Productivity and Culture, 43% of manufacturing companies report an average of at least 20% annual turnover that costs manufacturers hundreds of thousands-if not millions-of dollars dollars annually.3

Citing Forbes magazine as a source, the Arizona Republic reported that more than half of the existing skilled labor pool in job categories such as machining consists of workers ages 45 and older.7 Other sources like American Machinist put the number at 72%.8 The physical demands of these industrial production positions make it increasingly challenging for older employees to remain in the job market as they approach retirement age. So, they exit the workforce and create vacancies. Although younger entrants into these fields may accept lower pay, that cost savings often comes with a comparative lack of experience that many production operations find unacceptable.

Citing Forbes magazine as a source, the Arizona Republic reported that more than half of the existing skilled labor pool in job categories such as machining consists of workers ages 45 and older.7 Other sources like American Machinist put the number at 72%.8 The physical demands of these industrial production positions make it increasingly challenging for older employees to remain in the job market as they approach retirement age. So, they exit the workforce and create vacancies. Although younger entrants into these fields may accept lower pay, that cost savings often comes with a comparative lack of experience that many production operations find unacceptable.

The Grainger report listed several strategies that manufacturers are taking to face this situation, including the development of apprenticeship programs and college/tech school partnerships.5 A 2018 article in the Springfield News-Sun reported that some manufacturing firms are boosting wages to compete for candidates.10 Harvey Tool Company, a provider of specialty carbide end mills and cutting tools to the metalworking industry, identified employed machinists as the best source to encourage today’s youth to join the profession through community outreach and networking initiatives.11

These are all viable options to alleviate the problem. Another one mentioned in the Grainger report, staff reduction, could make the most business sense for metalworking operations adapting to severe economic turbulence. One way to achieve this goal is to automate as many plant processes as possible so they require fewer workers to get the job done.

Scrap handling systems, fluid recycling equipment and industrial water and wastewater treatment solutions offer automation opportunities that not only address the staffing issue but offer other advantages that directly benefit the bottom line.

Handles the transportation of metal scrap from the point of production through load-out with a minimal amount of employee involvement. Conveyors also reduce the need to staff an operation with forklift truck operators. This helps eliminate one of the most strenuous manual tasks in a metalworking operation while improving the overall safety of the workplace. Both outcomes can contribute to employee attraction and retention while lowering labor-related costs.

Automate the process of reducing turnings and bushy wads to flowable, shovel-grade chips while separating scrap from fluid. These systems improve productivity by freeing up workers to focus on production and throughput. They also reduce the potential for dangerous contact with sharp metal material, minimize environmental risks and position an operation to receive maximum value from scrap metal recycling and reusing spent coolant. Vertical axis crushers, for example, maximize labor allocation by providing continuous, positive feed operation and automatically removing occasional solids to prevent equipment damage.

Automatically remove free-floating and mechanically dispersed tramp oils, bacteria, slime, inverted emulsions and more from individual machine sumps, central systems and wash tanks. This equipment eliminates the need to have employees manually vacuum oil from the rinse tanks and is capable of reducing tramp oil to less than 1% in a single pass. Additional benefits include reducing new fluid purchase costs up to 75% and reducing hazardous waste volumes up to 90%.

Help simplify the process of unloading carts with efficient one-person operation that involves using a handheld control to operate the equipment.

Complete the scrap handling process by moving metal scrap to distribution bins for haul-away to the recycler. These systems provide efficient, automated, and even filling for maximum container fill and maximum value from the recycler.

Modern equipment in each category (conveying, scrap handling, fluid recycling and water/wastewater treatment) is also designed to deliver maximum uptime with low maintenance. This eliminates the need for an operation to be overstaffed with maintenance technicians and also helps ensure that employees are as productive as possible.

Productivity improvements in today’s manufacturing plants and machine shops are typically derived from the evaluation of the machining equipment, operating procedures, and labor allocations associated with process-side activity. Continuous improvement in this area should also include waste streams, which offer several opportunities to address an increasing problem in the industry: staffing a plant with a skilled workforce. Automation also keeps the production line flowing safely and efficiently, even as human resources become more limited.

Ineffective processes that are labor-intensive and require constant attention can only inhibit a metalworking operation meeting the challenges of an economic downturn. Working with an experienced equipment and systems provider to automate systems throughout a process can help metalworking plants succeed in an environment where retaining qualified employees continues to be a challenge.

Mike Hook is the Sales & Marketing Director for PRAB and has more than 15 years of mechanical design and application experience. PRAB is a leading manufacturer of engineered conveyors and equipment for processing turnings, chips and metalworking fluids. PRAB also designs and builds industrial wastewater recycling systems.

1 Scrap, Market Forecast: Remaining Resilient – https://www.scrap.org/home/scrap-articles/market-forecast-remaining-resilient#.Xo4Le4hKh-3

2 National Association of Manufacturers, How Coronavirus is Affecting Manufacturers – https://www.nam.org/how-coronavirus-is-affecting-manufacturers-7417/?stream=series-demystifying-data

3 The Fabricator, New Manufacturing Report Shows How Worker Turnover Costs the Industry – https://www.thefabricator.com/thefabricator/blog/shopmanagement/new-manufacturing-report-shows-how-worker-turnover-costs-the-industry

4 Bloomberg, GE Cuts 10% of Aviation Jobs in Sign of Virus’s Deepening Impact – https://www.bloomberg.com/news/articles/2020-03-23/ge-aviation-cuts-u-s-workforce-10-in-1-billion-savings-plan

5 Grainger, Metalworking Today: Three Trends to Watch – https://www.grainger.com/know-how/industry/manufacturing/kh-metalworking-industry-trends-to-watch

6 LIFT, Help (Still) Wanted: Manufacturers Struggle to Fill Open Jobs – https://lift.technology/help-still-wanted-manufacturers-struggle-to-fill-open-jobs/

7 Arizona Republic, Staffing Challenges in Production Operations – https://yourbusiness.azcentral.com/staffing-challenges-production-operations-29227.html

8 American Machinist, What Happens When the Baby Boomers Retire? – https://www.americanmachinist.com/shop-operations/media-gallery/21901463/what-happens-when-the-baby-boomers-retire

9 St. Louis Post-Dispatch, St. Louis Area Factories Say They Have Plenty of Work, But Not Enough Skilled Workers – https://www.stltoday.com/business/local/st-louis-area-factories-say-they-have-plenty-of-work/article_8a095652-4795-5244-a3e1-80da37d4bfa4.html

10 Springfield News-Sun, Companies Increasingly Competing for Workers – https://www.springfieldnewssun.com/news/local/companies-increasingly-competing-for-workers/DnbVt3E7pw5o72WDa73g0H/

11 Harvey Tool Company, 3 Ways to Help Solve the Machinist Shortage – https://www.harveyperformance.com/in-the-loupe/3-ways-solve-machinist-shortage/