Global health events. Trade wars and tariffs. Political discord. Rising foreign labor costs.

External factors such as these have had a major impact on U.S. manufacturing. Many companies were challenged in 2020 just to complete ordinary day-to-day production tasks due to supply chain disruptions during COVID-19. In fact, a National Association of Manufacturers survey reported that 59.5% of respondents experienced supply chain problems in the first half of 2020.1

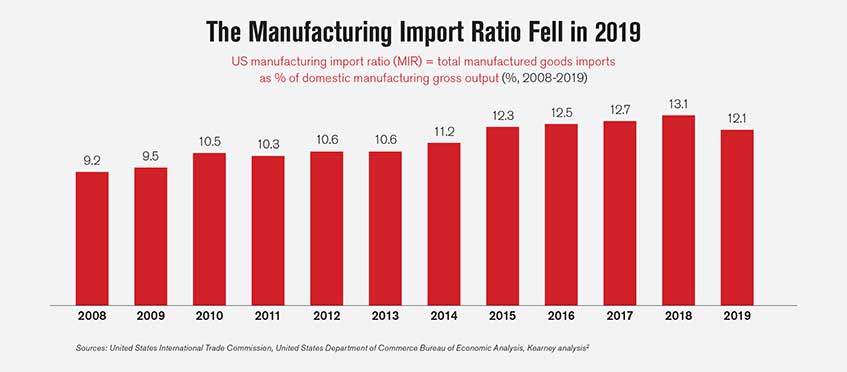

That being said, COVID-19 simply put an exclamation point on trends that were surfacing prior to the pandemic. For example, a pivot away from sourcing goods from China was already underway as a response to the trade war. According to the Kearney U.S. Reshoring Index, a dramatic shift occurred in 2019, when the U.S. manufacturing import ratio (MIR) contracted a little over 7%, the first decline since 2011.2 Kearney attributes the decline to a collapse in imports due to the trade war with China.

These shifts indicate that the manufacturing landscape is in fact changing. After a steady 40-year decline, the United States is on the precipice of a new chapter. As more manufacturers continue to minimize their reliance on global supplies and, moreover, the industry looks to rebuild the domestic manufacturing sector, it is expected manufacturers will accelerate reshoring and nearshoring activities. In fact, a Thomas Industrial Survey reported that more than 60% of the manufacturers and suppliers surveyed said they are likely to return operations to North America.3

Although a return to domestic manufacturing is gaining momentum, it is not without its challenges. If these challenges are not pre-emptively addressed, they will undermine a company’s ability to realize domestic growth. Here are three aspects of domestic production that U.S. manufacturers must consider in order to position their operations for long-term, sustainable growth.

1. Estimating the total costs of your company’s sourcing strategies is critical.

According to the Reshoring Initiative, most companies base their sourcing choices on ex works costs, wage rates, or landed cost.4 This approach ignores other assumed costs and risks that actually drive up the total cost of ownership (TCO). The Reshoring Initiative reports that a failure to account for overhead, balance sheet, risks, corporate strategy, and other external and internal business considerations can result in a 20-30% miscalculation of actual offshoring costs.5 Furthermore, transportation logistics and quality issues can compromise throughput.

Establishing new sourcing protocols doesn’t necessarily need to be an all-or-nothing approach. Some manufacturers may find that a blended approach is the best path forward.

A survey by Gartner Inc. revealed that 55% of supply chain leaders expect to have a highly resilient supply chain in two to three years, with 33% or respondents indicating they have or will move sourcing and manufacturing activities outside of China.6 But just as manufacturers need to take a look at the total costs of offshoring, a decision to reshore cannot be an isolated, short-term strategy.

Here are just two examples why reshoring should not be pursued in a vacuum:

1. Developing regional supply chains is one way that businesses can split the cost of capital and labor. Although this approach will streamline the supply chain, minimize risk, and improve quality, standing up a regional or local supplier network will take time and investment.

2. Bringing manufacturing in-house will certainly eliminate risk and supply issues, but it could result in high capital expenditures. For example, modest in-house machining capabilities, such as a single 5-axis mill, can cost over $350,000 per year. To equip a large-scale machine shop it can cost upwards of $2 million to operate.7

Manufacturers need to off-set costs or generate revenue in other aspects of the operation in conjunction with supply chain modifications or reshoring initiatives. Systems that automate waste streams are one way to achieve this. Companies that take this proactive approach will be better positioned to withstand not only future disruptions, but unforeseen costs and complexities in the interim.

3. Reshoring will create U.S. manufacturing jobs, but a skilled worker shortage will not only persist, it will worsen.

In 2018, reshoring and foreign direct investment (FDI) added 145,000 jobs from 1,389 companies. That same year Deloitte and The Manufacturing Institute estimated that between 2 million and 2.4 million jobs manufacturing jobs could go unfilled in the next 10 years, with the expectation that the situation would get worse.

Although COVID-19 job losses interfered with that projection in the short-term, rebuilding manufacturing in the U.S. became a ubiquitous battle cry for post-pandemic economic recovery. Every manufacturer who wants to grow the bottom line must adapt operations to reduce manual labor and create production efficiencies. Exploring how automated systems will reduce downtime and increase throughput will be a pathway toward sustainable growth.

After World War II, U.S. manufacturing needed to be re-tooled to meet rising consumer demand. PRAB founders Peter Ruppe and Alan Bodycomb launched PRAB and began engineering industrial conveyors and chip processing systems that enabled manufacturers to automate processes, reduce manual labor, improve safety, and increase throughput.

Since then PRAB has developed 12 different conveyors, engineered modular and skid-mounted chip systems that automate processing, and provided fluid filtration systems designed to recover valuable cutting fluids for recovery and re-use. The company also provides water processing technologies that are helping manufacturers reduce their water and wastewater treatment expenses.

Return on investment is a key value proposition of PRAB’s automated equipment solutions. Manufacturers across the country in a range of industries are seeing on their balance sheets how PRAB systems reduce manual labor, decrease downtime, and lower expenses—and, in some cases, generate revenue.

Partnering with U.S. suppliers who have demonstrated a commitment to domestic production will decrease risk substantially.

Since its founding, Michigan-based PRAB has been an organization focused on excellence. As such, the PRAB team is doing their part to help restore the economy. The company has instituted numerous safety protocols to keep employees and customers safe amid COVID-19. Resolve, caution, and a calculated approach to operating during the pandemic has enabled PRAB to continue traveling to help metalworking operations and other manufacturers implement and manage their automated solutions. Manufacturers who adopt a similar posture for increasing domestic production will position their company for fewer disruptions and sustainable growth.

Mike Hook is the Sales & Marketing Director for PRAB and has more than 15 years of mechanical design and application experience. PRAB is a leading manufacturer of engineered conveyors and equipment for processing turnings, chips, and metalworking fluids. PRAB also designs and builds industrial wastewater recycling systems.

1 National Association of Manufacturers, NAM Manufacturers’ Outlook Survey Second Quarter 2020 – https://www.nam.org/wp-content/uploads/2020/05/NAM-2020-Q2-Outlook-Survey.pdf

2 Kearney, “Trade War Spurs Sharp Reversal in Reshoring Index, Foreshadowing COVID-19 Test of Supply Chain Resilience,” – https://www.kearney.com/operations-performance-transformation/us-reshoring-index/full-report

3 Cathy Ma, “60% of U.S. Manufacturers Say Business Has Been Impacted by Coronavirus,” Thomas Insights – https://www.thomasnet.com/insights/60-of-u-s-manufacturers-say-business-has-been-impacted-by-coronavirus/

4 Reshoring Initiative, “Impact of Using TCO Instead of Price,” – https://www.reshorenow.org/blog/impact-of-using-tco-instead-of-price/

5 Reshoring Initiative, Total Cost of Ownership Estimator®, – https://www.reshorenow.org/tco-estimator/

6 SDC Supply & Demand Chain Executive, “Gartner Survey Reveals 33% of Supply Chain Leaders Moved Business Out of China or Plan to by 2023,” – https://www.sdcexec.com/risk-compliance/press-release/21138109/gartner-inc-gartner-survey-reveals-33-of-supply-chain-leadersmoved-business-out-of-china-or-plan-to-by-2023

7 Jim Quinn, SDC Supply & Demand Chain Executive, “Reshoring and Your Bottom Line,” – https://www.sdcexec.com/sourcing-procurement/article/21136306/reshoring-and-your-bottom-line

PRAB has a portfolio of over 39 customizable equipment offerings across 4 divisions, all unified under the PRAB brand—offering metal chip processing equipment, fluid filtration equipment, conveyors, industrial water & wastewater treatment equipment, parts, services, and solutions to meet the unique needs of a variety of customers and industries around the world. Products are engineered and built to last. As testimony, PRAB has equipment still operating in the field that was installed over 57 years ago. For more information visit prab.com.