But “crisis mode” is not a viable business model. As such, manufacturers are evaluating what they need to do not only for the short term, but what adjustments they need to make in order to advance business goals and establish sustainable growth for the years ahead. Making calculated investments to facilitate operational improvements-and financing those investments in a manner that will not compromise cash flow- will be fundamental to post-pandemic success. With that in mind, this white paper will:

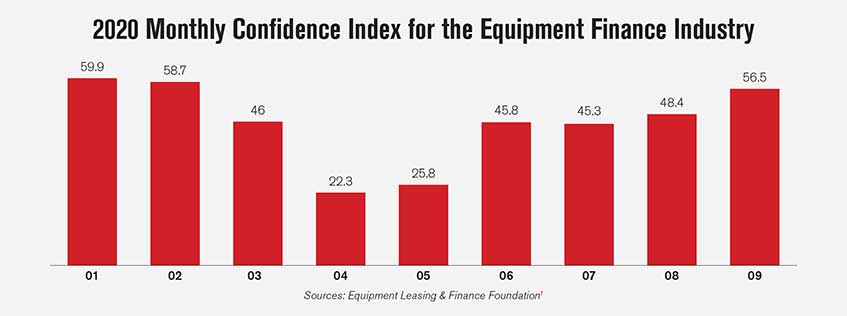

What’s more, banks were poised to not only provide pandemicrelated financial relief, but capital to finance operational advancements. The Equipment Leasing & Finance Foundation reported in its Monthly Confidence Index for the Equipment Finance Industry that confidence was 56.5 in September 2020, compared to 23.3 in April of 2020. The September rating was actually higher than the September 2019 rating of 54.7.

When The Federal Reserve slashed interest rates to near zero in March of 2020, it created a mechanism to support the flow of credit to U.S. businesses. Historically, when the Fed cuts interest rates it enables banks to borrow from the Fed on more favorable terms. In the past, banks and their financing arms have pounced on these favorable terms to deliver as many qualified loans at lower interest rates to their customers as possible.

In September of 2020, Federal Reserve officials indicated that the low rates will remain “until the economy is far along in its recovery.” In the September statement, the Federal Open Market Committee said it would hold rates near zero until the job market reaches full employment “and inflation has risen to 2% and is on pace to moderately exceed 2% for some time.” That will likely not occur until at least 2023.2

With manufacturing optimism rebounding and the availability of cheap capital, established manufacturers—particularly mid-sized companies-face a unique opportunity to fund operational improvements in an extremely low-impact manner. By utilizing a low-interest loan to finance capital expenditures that will have a quick and steady return-on-investment, manufacturers may be able to subsidize principal and interest payments through the cash flow improvements. Under these circumstances, being cash flow positive may be possible almost from the onset of the loan. To take full advantage of this, manufacturers will need to:

Lenders may have favorable terms at their disposal, but they will also be looking to minimize their own risk. Proceed with loan inquiries diligently. Navigating loan requirements can be a complex undertaking during the best of times-add in secondary financing distributed to help businesses bridge financial gaps resulting from an economic crisis and the requirements can become more restrictive. When pursuing a new loan, be sure to verify it will not interfere with the terms of existing loans.

U.S. Small Business Administration Loans

The U.S. Small Business Administration (SBA) offers programs to small businesses to fund growth. The SBA qualifies small manufacturing operations as having a maximum number of employees ranging from 500 to 1,500, with the cap varying for different industries.

To learn more about these programs and size requirements, visit www.sba.gov. Larger businesses should discuss existing or prospective equipment financing partners with their finance team.

Suppliers of automated systems who are trusted partners will help their customers estimate the ROI well in advance of a signed purchase order. For instance, PRAB provides metalworking operations access to an online ROI calculator for its Guardian™ Coolant Recycling System, which typically has an ROI of 6 to 9 months. Customers input a few details about their metalworking operation and how cutting fluids are purchased and used, and the calculator provides an estimate of annual projected savings:

For metalworking operations that want to know upfront how PRAB’s advanced metal scrap processing equipment will improve their bottom line, PRAB will process a sample of their metal scrap in its test lab to determine the moisture reduction, volume reduction, and fluid recovery a PRAB metal scrap processing system will yield:

SAMPLE MATERIAL TEST

Material type: Steel

Description of material: Small stamping scrap

Quantity: Two 55-gallon drums

Purpose of test: Fluid recovery

Equipment tested: PRAB Screw System Feed Conveyor

and Diagonal Shaft Wringer

RESULTS:

Volume Reduction (Bulk Densities): 150lbs/ft3

Moisture Before Processing: 2.67%

Moisture After Processing: 0.89%

Fluid Recovery: Approximately 10 gallons

Throughput Rate: 4,000 lbs/hr

With this level of data, metalworking operations can project the metal scrap processing system’s ROI and get a realistic idea of the positive impact the savings could have on cash flow.

Source: PRAB Guardian™ ROI Calculator3

Collaborate with a trusted supplier of back-end systems to project the equipment’s ROI and build consensus about the value of the CapEx-both internally and with lenders. Taking this approach will position the company to grow even amid the most difficult economic circumstances.

1 Equipment Leasing & Finance Foundation, Monthly Confidence Index, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/

2 Smialek, Jeanna, Fed Pledges Low Rates for Years, and Until Inflation Picks Up, https://www.nytimes.com/2020/09/16/business/economy/federal-reserve-interest-rates.html

3 PRAB Guardian™ ROI Calculator, https://www.prab.com/estimate-your-fluid-savings-prab-guardian-roi-calculator/

Mike Hook is the Sales & Marketing Director for PRAB and has more than 15 years of mechanical design and application experience. PRAB is a leading manufacturer of engineered conveyors and equipment for processing turnings, chips, and metalworking fluids. PRAB also designs and builds industrial wastewater recycling systems.