In 2010, Modern Machine Shop magazine released its inaugural “Top Shops” benchmarking survey. Intended as an annual method for metalworking shops to compare their key performance indicators with those from the upper echelon of machining businesses, the survey poses questions about specific machining and shop floor approaches as well as general business and operational practices.

The goal is to present data from the survey to help companies become more competitive in the global marketplace by emulating the practices of leading parts manufacturers. Each year, the results offer interesting findings that give survey participants a sense of how they stack up against the top shops.

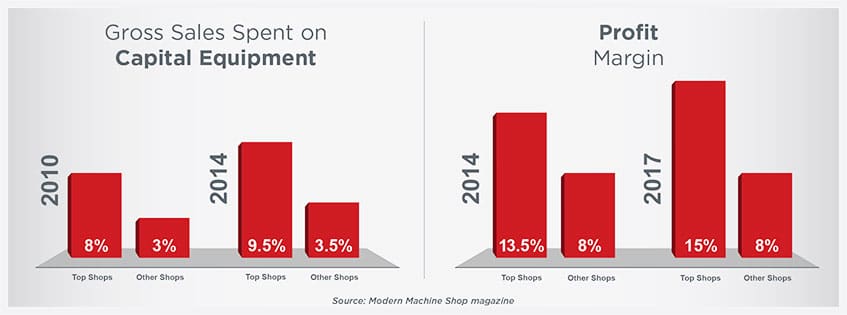

Over the years, one piece of data in particular has remained consistent: In 2010, the top shops invested 8 percent of their gross sales in capital equipment, versus 3 percent for the other shops.1 In 2014, those shops invested 9.5 percent of their gross sales in capital equipment, compared to 3.5 percent for other shops.2

Machine manufacturer Gosiger offered similar data in support of this business approach. The company cited a study conducted by Gardner Research to better understand what separates highperformance shops from average ones in the areas of income, profit, and growth. The study found that better-performing shops consistently invest in new equipment in order to maintain a current manufacturing environment.3

Of course, the biggest indicator of business health is profit margin. The 2014 “Top Shops Report” indicated that the median profit margin of top-performing shops was 13.5 percent, compared to 8 percent for other shops. In 2017, the number was 15 percent, compared to 8 percent.4

For all businesses, the key is to achieve the largest profit margins possible. One way for metalworking operations to attain that goal appears to be investing in capital equipment—an investment that should not be limited to production equipment. In this white paper, we will examine some of the factors that can significantly impact profit margins for metalworking shops. Additionally, we will make the case for minimizing that impact with metal scrap processing equipment and fluid recycling systems.4

Factors that are beyond an operation’s control are often among the most detrimental to a healthy bottom line. Two of the biggest market realities that metalworking shops are dealing with in 2019 are unavoidable and cannot be ignored.

In March 2018, the United States imposed a 25 percent tariff on steel imports and a 10 percent tariff on aluminum imports, with exceptions for Canada and Mexico. The president defended the move, saying the tariffs were necessary to protect domestic steel production facilities and reduce American reliance on imported metal.

Despite promises of long-term benefits, many readers of The Fabricator were feeling the short-term pain. Soon after the tariffs were enacted, the publication conducted an unscientific poll of 26,000 subscribers of its e-newsletter and asked them to share their views of the tariffs and the impact they may have on their operations.

Of those who responded, 55 percent did not have a favorable opinion of the tariffs. Some of the opposition’s responses shed light on how businesses might be negatively affected5:

An article in Canadian Metalworking magazine confirms what many already assume—that people in the machining industry tend to think of coolants, cutting oils and other metalworking fluids as a necessary evil. The article contends that many decision-makers in a manufacturing operation, whether it is a small job shop or a huge automotive or aerospace supply plant with a global customer base, tend to think of coolant only when there is a problem with it within the facility.6

From a dollars and cents standpoint, MoldMaking Technology magazine cites industry estimates that metalworking fluids make up as much as 10 percent of the cost of a finished part. This figure includes the initial cost of the concentrate, housekeeping, cleaning, and disposal. For comparison, the same sources estimate that tooling only makes up about 6 percent of the cost of a finished part. When you factor in the ever-increasing price of cutting oil concentrate and the rising costs of spent fluid disposal, the goals of any metalworking fluids management initiative should be to increase the life of the fluids.7

Whether it’s a largely unforeseen circumstance like an industry-wide implementation of a new international trade policy or a somewhat expected occurrence like an increase in the price of coolant concentrate, basic costs of doing business are a fact of life for every metalworking operation. Fortunately, there are many scrap metal processing and fluid recycling solutions available today that can help an operation respond to these factors and move profit margins in a positive direction.

Scrap metal recycling begins with volume reduction. Turning and chip processing systems offer the dual benefit of reducing small to medium volumes of turnings and bushy wads to flowable metal chips while also separating chips from fluid. This positions an operation to increase the value of its machining scrap and reuse its cutting fluid.

Typical scrap removal systems include a crusher/wringer or a shredder/wringer, which process loose metal turnings to deliver dry, flowable, shovel-grade chips and reclaim up to 99% of valuable coolants and cutting oils. Wringers and centrifuges offer another method of chip and fluid separation by using more than 600Gs of centrifugal force to create dry chips and reclaim up to 99% of cutting fluid.

Compacting dry, loose chips into smaller, denser briquettes is one way an operation can dramatically increase the value of its metal scrap. Briquetting machines compress metal chips, loose turnings, and swarf into near solid, dry briquettes for feeding to furnace (these scrap pucks are easy to re-melt, transport, or store for more floor space and a cleaner shop) or to send for recycling (because of their condensed volume, briquettes offer optimized container fill and bring higher value from the recycler). Briquetting machines that use two opposing hydraulic cylinders are able to press metal equally from both sides to create the driest, most compact scrap pucks possible. After the cutting oils are separated from the scrap, the right Fluid Management Program (FMP) can help an operation decrease its spending on new coolant purchases. A variety of equipment and system options can reduce costs associated with the mixing of fluids used for cooling, lubricating, and removing fines/cuttings from the cutting zone, as well as those used in corrosion protection.

Centralized coolant recycling systems remove tramp oils and suspended solids from contaminated coolant, control bacteria, and can adjust fluid concentration for fluid recovery. The benefits to the bottom line by adding a centralized system include reducing new fluid purchase costs by up to 75% and reducing hazardous waste disposal costs by up to 90%. Utilizing a coolant manager in conjunction with a centralized recycling system can prevent coolant rancidity by injecting ozone. These recycling systems can extend tool life and help a shop reduce new tool purchases by 25%.

Magnetic separators also prolong tool life and are well-suited to processes where ferrous contaminants are mixed with water-based coolants or straight cutting oils. They employ high-intensity ferrite or rare earth magnets within a fully energized rotating drum to continuously remove ferrous particles from the flow of liquid, which can reduce machine downtime by up to 50%—a major contributor to a healthy profit margin. These systems are often used as a pre-filter to limit contaminants reaching subsequent filtration equipment.

Paper bed filters can extend tool life by an average of 27%, improve surface finish and prolong coolant life by removing solids and other materials from all free-flowing industrial process liquids. Standard paper bed filtration systems are available with flow rates up to 130 gpm and different classes of filter fabric. This allows for adjustments of micron clarity to achieve optimal removal of ferrous and non-ferrous metals as well as organic and inorganic contaminants, such as dirt, glass, rubber, and plastic.

When budgets in a metalworking operation are tight, often due to factors that are beyond the operation’s control, financial decisions related to purchasing capital equipment tend to favor front-line systems such as CNC machines, mills, lathes, and band saws. But the systems that handle the back-end of the process, byproducts like scrap metal and spent fluid, can be equally important to improving a shop’s profit margin.

Implementing these systems can save money, generate revenue, and increase the value of the business as a whole. In many cases, prioritizing these kinds of systems requires a reversal of conventional wisdom. Doing so can be difficult, but ultimately it is a worthwhile approach when you consider the fast ROI and the increased value and efficiency a scrap handling and fluid recycling solution can bring to a metalworking operation.

Mike Hook is the Sales & Marketing Director for PRAB and has more than 15 years of mechanical design and application experience. PRAB is a leading manufacturer of engineered conveyors and equipment for processing turnings, chips and metalworking fluids. PRAB also designs and builds industrial wastewater treatment systems.

1 Modern Machine Shop, “Top Shops” Benchmarking Data Sheds Light on What It Takes to Be One of the Nation’s Leading Machining Businesses – https://www.mmsonline.com/articles/see-how-you-stack-up

2 Modern Machine Shop, Best Practices of Top U.S. Shops – https://www.mmsonline.com/articles/best-practices-of-top-us-shops

3 Gosiger, 4 Success Secrets of the Most Profitable CNC Machine Shops – https://www.gosiger.com/news/bid/162655/4 Success-Secrets-of-The-Most-Profitable-CNC-Machine-Shops

4 Modern Machine Shop, Top Shops Benchmarking: Providing Direction, Gaging Performance – https://www.mmsonline.com/articles/top-shops-benchmarking-providing-direction-gaging-performance

5 The Fabricator, What Fabricators Think of the Steel and Aluminum Tariffs – https://www.thefabricator.com/blog/what fabricators-think-of-the-steel-and-aluminum-tariffs

6 Canadian Metalworking, Coolants 101 – https://www.canadianmetalworking.com/article/cuttingtools/coolants-101

7 Mold Making Technology, Coolants and Coolant Management – https://www.moldmakingtechnology.com/articles/coolants-and-coolant-management

PRAB is a leading engineer and manufacturer of conveyors and chip and fluid management systems. Its customized solutions automate metal handling, reduce labor costs, reclaim and recycle expensive cutting fluids/coolants, and maximize return on recycling metals. With its expertise honed by more than 4,500 installations for the world’s leading OEMs and suppliers, PRAB continuously improves material handling, housekeeping, and compliance to environmental rules and regulations within the automotive, aerospace, medical, electronics, defense, off-road, and energy markets. For more information about PRAB, visit prab.com.